Unlock Editor Digest for FREE

Roela Khalaf, Ft Editor, selects his favorite stories in this weekly newsletter.

A fall in the US bond harvest is the pressure of the dollar, while investors bet the economic growth will push the Federal Reserve to keep the cutting interest to keep the interest to keep the interest to keep the interest in the regular inflation.

The 10-year harvest of Treasury fell to 4.32 percent on Tuesday, the lowest level since the middle of December. Reduced from above 4.8 percent last month was prompted by an aggravated view for US growth, after a String of data showed weak feeling of consumer and business.

To hit the DOLLARSNow down 1.9 percent of this year against a basket of its peers, humbling to expect Donald Trump’s return to the White House continue to control money. The dollar that has previously reinforced the stakes that the impact of inflationary tariffs of new presidents and immigration turbs will prevent the fed to cut rates.

“Slow growth and higher expectation of inflation is a more negative mix for US dollar,” Lee Hardman, analyst currency in Banking Group Mufg.

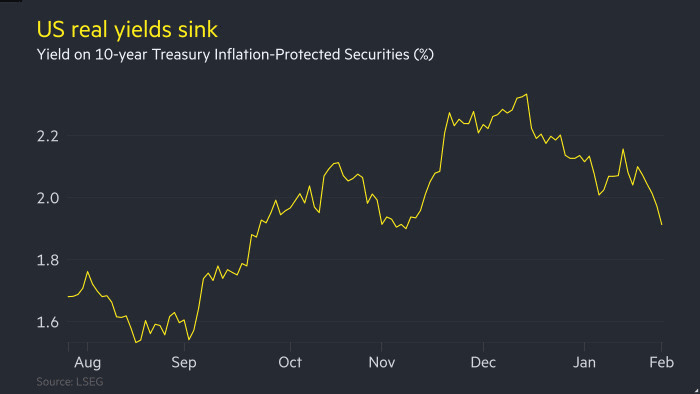

Investors say the fall in real treasury The yields, representing the offer return after viewing inflation, a significant money driver.

The harvest of 10 years Treasury Inflation-Ceptenity Security (tips) dropped 1.9 percent last Tuesday, from early morning from 2.3 percent last month.

The steady inflationary pressures that put up the intensify of a binding, because it naturally responds by slowing down or terminating its cutting rate. But the growth of flow – and repeated wide from Trump asking that Fed Chair Jay Powell is low lending costs – pushing in another direction.

Trump at the beginning brightly criticized Fed after it rated last month, but later said it “the right thing to do”.

JPMorgan analysts highlighted in a note last week the “significant breaking of true yields (appropriate) in an indestructible policy field in front of a sharp tariff flowing tariff in the front inflation “.

Inflation expectations are expected to inflation as the price of investors is likely to impact Trump’s tariffs. So called two-year break-evencens – to measure the difference between true yield and nominal produce and led their supreme under the early 2023.

US inflation is unexpectedly increased by 3 percent of January and the most recent minutes warns “uphill risk” for inflation. Consumers’ expectations expected for long price was the maximum since 1995.

However investors bet on the Fed shorter rates by increased half-percentage point at the end of the year.

The fund managers say the market takes a mimmer view of the threat of home progress from the new President, as well as a cracking trade and withdrawal of cracking the public in the public sector.

Nominal US treasury crops also dropped from their peak in the middle of January.

“Markets ask if we have seen US dealer Matthew Morgan, led by the Pandet fairly, as well as the path of the sacrifice of the dispos, Also the tariffs of the dispolicant’s path, as well as Tarko on the way to monetary policy, as well as Tarko on the road to monetary, as well as Tariffs on the path of the sacrifice of the dispolic, as well as the path of the sacrifice of the diset, as well as tariffs on the path of the disand, as well as Tarko on the way to monetary, as well as the tarsquare of the monetary. Asset’s Prayer Road, and Government Damages, “can be explained less investment, rental and growth”.

Besides the weaker dollar and low yield, he said, “The next question is when a US growth growth leads to a repriKsy of risks”. After hitting a series of records on the record, stocks lost land in recent sessions.

A S & P vehicle of managers published last week is shown the US service sector contracted for the first time for more than two years.

UBS’s analysts speak earlier this month that falls in real produce, while inflation expectations remain high, showing a “mouncelationary automatically.