A White House official recently proposed a plan to let Americans use their 401(k) savings to buy homes, but the formal proposal didn’t pan out as expected.

National Economic Council Director Kevin Hassett told Fox Business News On January 16, the government planned to “allow people to take money out of their 401(k) plans to make a down payment.” President Donald Trump plans to unveil a final plan for this in Davos, he said.

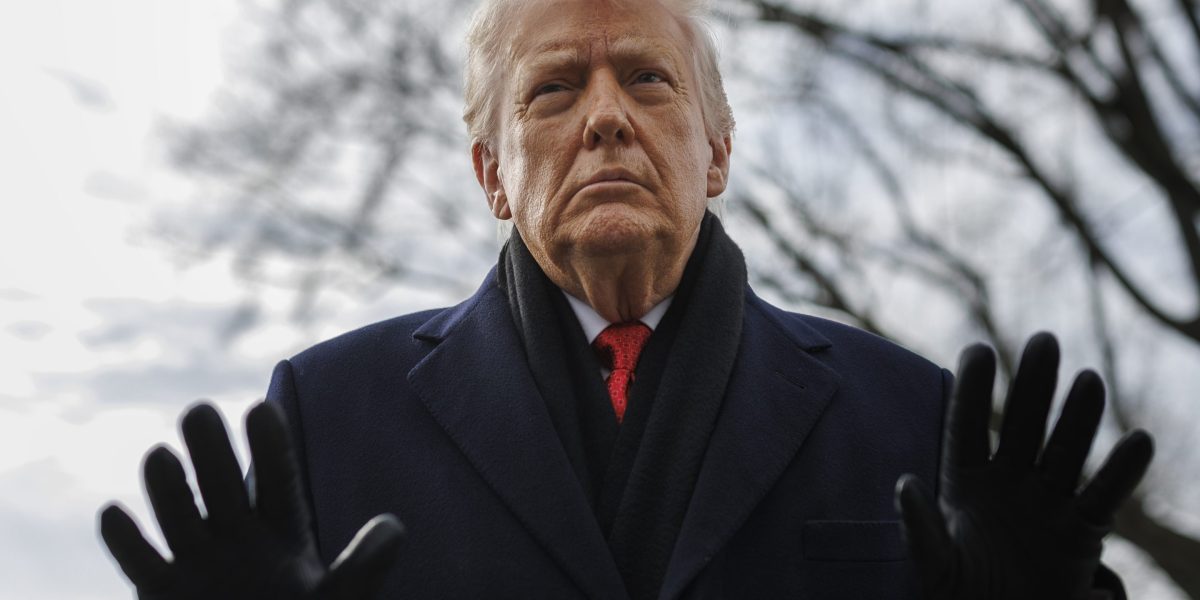

Trump ultimately did a U-turn on the proposal when asked about it in Davos, tell reporters He’s not “enthusiastic” about letting 401(k) plan participants use part of their savings for a down payment on a home. “I’m very happy with what the 401(k) is doing,” he added.

Home Buying > Retirement? Currently, 401(k) participants must Pay an additional 10% tax Withdrawals of funds from an account before age 59 1/2 for a variety of reasons, including buying a home (also known as a premature distribution). The rules are different for Individual Retirement Accounts (IRAs), which allow eligible first-time homebuyers to withdraw up to $10,000 without paying a 10% penalty.

Some employers allow workers to take loans from their 401(k) account balances to purchase homes. below Current IRS regulationsthe loan cannot exceed 50% of the participant’s vested balance, or $50,000.

Even before Hassett’s recent policy ideas, workers were already taking advantage of these options. By 2024, nearly a quarter of home buyers Zillow Survey Retirement funds (i.e. 401(k), IRA or 403(b)) have been tapped to help with the down payment.

It’s unclear how the White House proposal compares to existing options, but Hassett told fox The business’s goal is to help Americans buy a home and then use the equity in that home to put money back into their 401(k) accounts.

“We’re still discussing the mechanics of it, but let’s say you put 10 percent down on a home, and then you take 10 percent of the equity in the home and put that into your 401(k) as an asset, then your 401(k) will grow over time as the value of your home grows,” he said.

Real estate and financial experts question the feasibility of the plan. “I don’t understand how they’re going to do that. There’s no way to get people to put their money back. You can’t contribute more than the allowed amount in any given year,” said Craig Copeland, director of wealth benefits research at the Employee Benefit Research Institute (EBRI). tell market watch.

Jake Krimmel, an economist at Realtor.com, said allowing potential homebuyers to acquire previously illiquid assets could lead to higher home prices. tell exit. “In the supply-constrained Northeast and Midwest, such reforms could make affordability issues even worse,” he said.

Although Trump backed away from Hassett’s proposal, some lawmakers still appear interested in such a plan. Rep. John McGuire, Republican from Virginia, introduced a bill On January 21, the bill will allow penalty- and tax-free 401(k) withdrawals for home purchase expenses, such as closing costs and down payments.

historically high price and a Insufficient supply of available homes already own a home Out of reach for many Americans in recent years. In light of these trends, some employers now offer Home buying benefits to their workers. Food processing company JBS Taking the United States as an example, Invested More than $20 million in affordable housing for workers in places like Saguaro, Texas, and Beardstown, Illinois. other employers may help subsidize An employee’s down payment or closing costs may contribute to the purchase of a mortgage loan.

This report is Originally published go through HR Brewing.