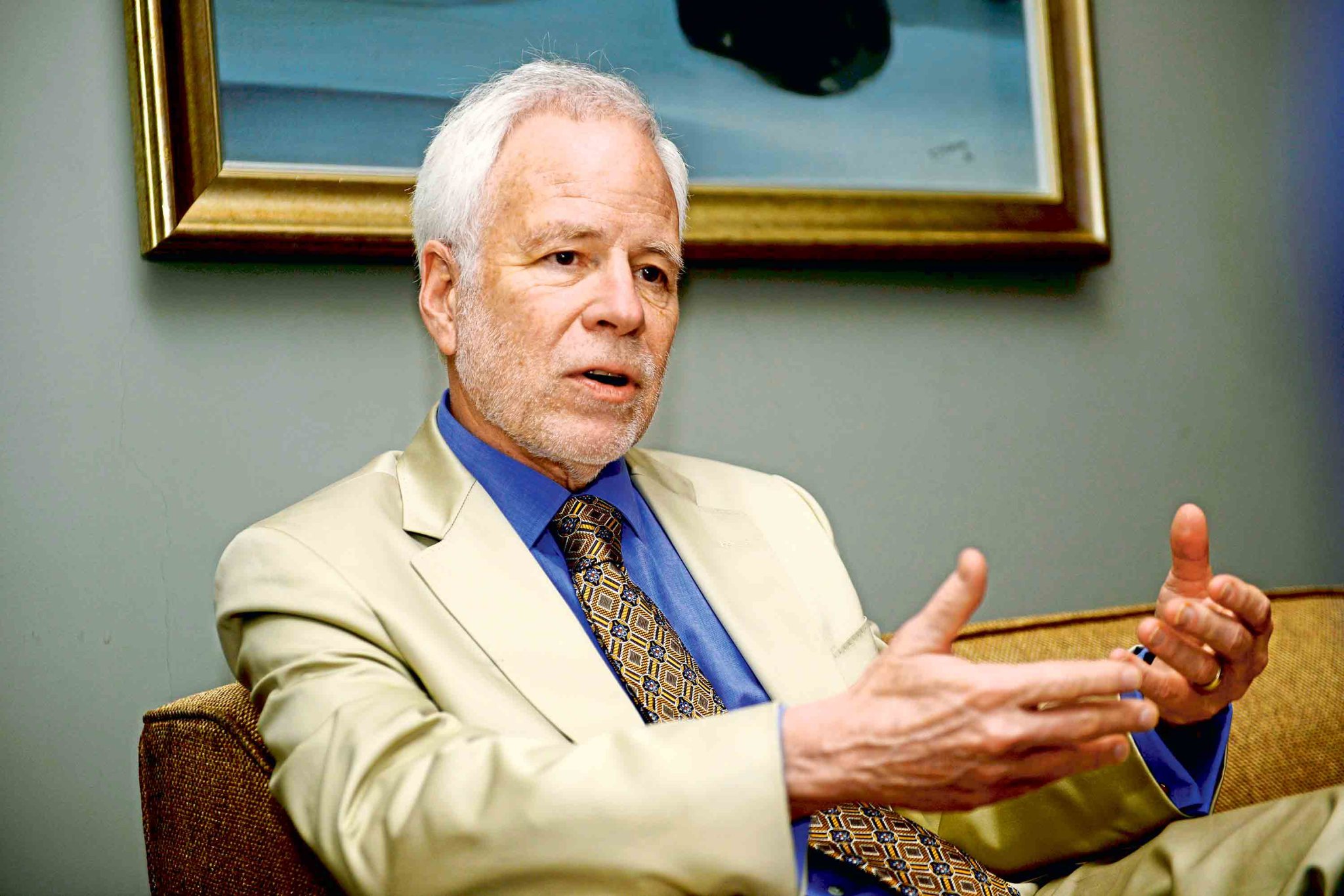

Top economist says America’s $38 trillion national debt isn’t really caused by math or budget issues Barry Eichengreen explain. This isn’t necessarily due to interest rates, an aging population, or even out-of-control spending.

The problem is us. Or more specifically, he told wealth In an exclusive interview, it’s a polarized political system that reflects and amplifies our divisions.

“The United States has forgotten the importance of fiscal discipline,” said the Berkeley professor of nearly 40 years. wealth. “Neither party is serious about trying to reduce the budget deficit. There’s a lot of hand-waving and rhetoric, but very little meaningful action.”

Eichengreen expanded on the conversation wealth in his new Peterson Foundation Papers The report tracks 24 years of uninterrupted increases in U.S. federal debt (currently $38 trillion, more than 100% of GDP) and concludes that polarization is a binding constraint that hinders any credible fiscal strategy. He warned that the United States was more similar to the indebted and politically divided economies of southern Europe than policymakers in Washington were willing to admit.

“Comparisons between the United States and Italy or Greece … those parallels are closer and more shocking today than at any time in my lifetime,” he said. “As time goes on, politics become more polarized and fiscal policy gets into trouble.”

Old debt reduction strategies no longer work

According to Eichengreen, America’s two major success stories—the post-World War II period and the 1990s—rested on three pillars: strong economic growth, favorable interest rates, and the political ability to maintain primary surpluses.

“Everything changed” in the 2020s, he said.

First, if the market doesn’t have “AI hope,” Eichengreen said, Overall growth was weak. Second, we are no longer in the era of ultra-low interest rates that contributed to previous debt consolidation; current interest rates are structurally higher relative to economic growth. Third, the political system is unable to generate sustained surpluses: this may be historical relics He suggested relegating it to the 20th century.

The problem, Eichengreen believes, is not a failure of economic imagination. This is a failure of political ability.

“Political polarizationHigher in the United States More than any other developed country for which we have comparable data,” he said. “This severely undermines our ability to achieve consensus, stability and productive policy outcomes. “

Eichengreen said his research shows that countries that have successfully reined in high debt, even painful debt, have one characteristic in common: bipartisanship. “Low polarization is the only factor that is strongly associated with successful debt consolidation,” Eichengreen said. “We (the United States) simply don’t have the capability.”

There is supporting evidence in the literature. one Report from the Manhattan Institute, Go to “Yes”Analyzing 14 major deficit reduction negotiations in the United States since 1980, we found that a successful fiscal agreement requires at least two conditions: a painful “punitive default” if no agreement is reached; broad public support for deficit reduction; and true bipartisan trust among negotiators.

Most of these elements existed in the 1980s and 1990s, Eichengreen said, but collapsed in the 2000s as partisanship intensified. The report believes that growing polarization, waning public concerns about deficits, and the political inaccessibility of rights make major fiscal consolidation much more difficult than in the past.

Not good at math. Politics is worse

In fact, Eichengreen said, the two most direct ways to lower the debt-to-gross domestic product ratio — spending cuts and raising taxes — are politically frozen.

“We learned last year that cutting government spending is very difficult,” he stressed. “Defense spending is under pressure. There are some entitlements that are politically impossible to cut.”

In fact, President Donald Trump has tried to cut some spending with the help of the world’s richest man and close friend Elon Musk. short-lived “DOGE” plan. Musk said they ended up cutting $160 billion from the federal budget: a lot of money, sure, but nowhere near the government’s $2 trillion goal. In addition, experts It is estimated now The disruption caused by DOGE cuts could cost taxpayers $135 billion this year in tax revenue and lost productivity.

Three-quarters of federal spending Locked in Social Security, Medicare and defense, none of which enjoy bipartisan support for reform.

At the same time, although the tax increase proposal historically modest These countries are considered off-limits relative to other wealthy economies.

“The United States remains a low-tax country,” he said. “There is room for revenue to increase by about 3% of GDP, which would cut the deficit in half. But the political system cannot do that.”

In other words, polarization turns simple arithmetic into an unsolvable equation.

America won’t solve its debt problem until it solves its political problems

Eichengreen emphasized that there is no “magic number” for a sudden debt crisis. But he believes the country is slowly heading towards a situation where bond markets lose confidence, as will happen in the UK in 2022 Lizzie Truss Episodes.

The former prime minister sparked a financial panic in 2022 when her government launched a massive, unfunded tax cut plan that markets viewed as fiscally reckless. Investors dumped British bonds, the pound plummeted, and the Bank of England had to intervene to prevent pension funds from collapsing, all of which led to Truz’s eventual resignation.

“This is not to say that the UK is about to default,” he said. “There is a sudden loss of confidence in the government’s ability to act as a reliable financial steward.”

A similar sudden shift in perceptions of U.S. capabilities, triggered by a failed auction, a political shock or a blow to the Fed’s independence, could force a fiscal reckoning much faster than Washington expects.

But he stressed that even this would be a political crisis that preceded the fiscal crisis.

“Every day that goes by makes me feel more urgent about the situation,” Eichengreen said. “But there is no way to restore fiscal sustainability without addressing polarization.”