President Donald Trump has backed down from his threat to impose tariffs on NATO allies in response to his plan to take over Greenland, but the diplomatic and financial damage has been done.

Dollar continues to fall, top Nordic investors reported Reassess their exposure to U.S. assetswhile Danish pension funds have sold government bonds.

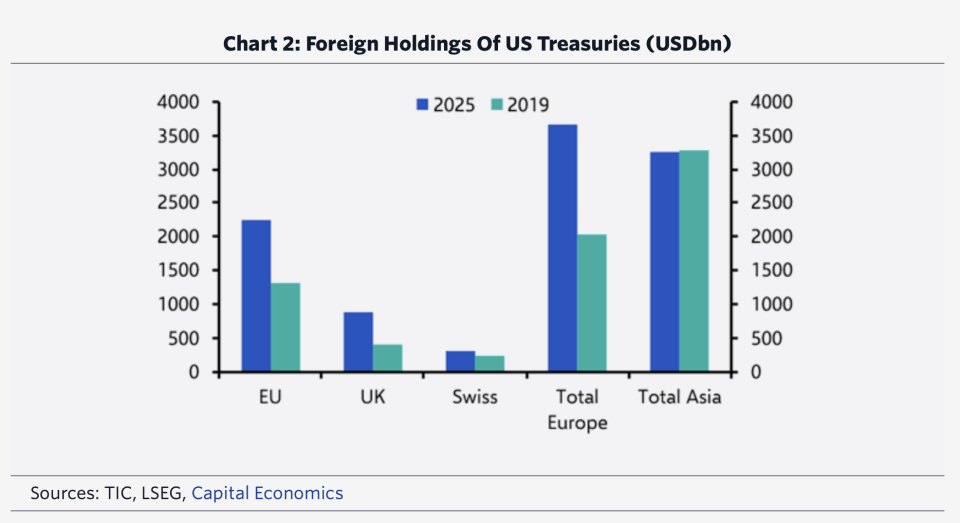

Part of the reason is concerns about U.S. debt, but Trump’s Greenland crisis and his continued unpredictability have also prompted calls for Europe to weaponize its capital. Actually, European investors own $8 trillion U.S. stocks and bonds, including $3.6 trillion in U.S. Treasury bonds alone.

European holdings of U.S. government bonds account for about a third of overseas holdings, or about 10% of the entire U.S. Treasury market, and their holdings have nearly doubled since 2019, according to a report from Capital Economics on Wednesday.

But it’s this huge stockpile that makes Europeans less likely to suddenly sell Treasuries because moving so much money would disrupt financial markets.

Why the United States Has “Escalation Dominance”

The report said a shift to alternative investments would cause these prices to spike and reduce their expected returns. Other safe-haven currencies, such as the Swiss franc and gold, have appreciated so much that their real yields are negative.

“Not only does this have a financial cost, it also invites the same response: US investors also own a lot of European government bonds!” added Jonas Gortmann, deputy chief market economist at Capital Economics. “Exceed European banks remain dependent on U.S. dollar funding, which is ultimately backed by the Federal Reserve. In military terms, ‘escalating dominance’ is firmly in favor of the United States. “

Michael Brown, senior research strategist at Pepperstone, also pointed out that a large portion of European holdings of U.S. stocks are for collateral or cash management purposes rather than for discretionary investment decisions.

Additionally, private investors hold U.S. assets even under these discretionary circumstances, meaning it would be nearly impossible for the government to force a sale, he said in a note Wednesday.

Selling Treasuries Will Hurt Europe

If Europe sells off U.S. Treasuries, bond prices will plummet “in a very violent way” with spillover effects elsewhere – including in the euro zone, where borrowing costs will soar.

Brown added that as the euro surges, currency markets will also experience turbulence, which poses a significant headwind to the euro zone’s exports and economic growth.

“If capital markets were to be seriously considered in any European retaliation, a more practical option would be to stage a ‘buyers’ strike’ at the upcoming Treasury auction, although this would be relatively difficult to implement in practice,” he explained.

This story was originally published on wealth network