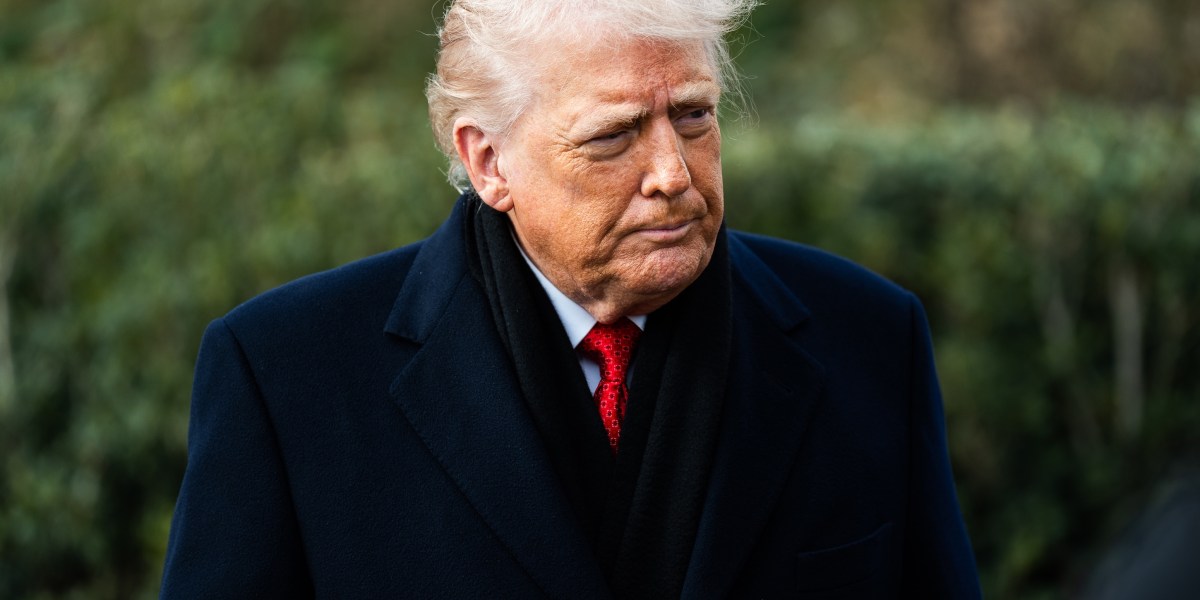

This morning in Davos, world leaders woke up to a global sell-off in stock markets: US President Trump has sent a text message to the Norwegian Prime Minister Says he has repeatedly threatened to take over Greenland because he did not win the Nobel Peace Prize.

“In light of your country’s decision not to award me the Nobel Peace Prize… I no longer feel obligated to consider purely peace, although peace will always prevail, but can now consider what is good and appropriate for the United States of America,” Trump’s message to Jonas Gall Stoll says. “Unless we have complete control of Greenland, the world is not safe.”

The Norwegian government has no control over how the Nobel Committee awards awards. Greenland is a territory of Denmark, not Norway.

late last night Trump posts on social media again”, “For 20 years, NATO has been telling Denmark, ‘You have to keep the Russian threat away from Greenland. ‘Unfortunately, there is nothing Denmark can do about it. Now is the time and it will be done! ! ! “

Traders, frustrated by the prospect of a renewed trade war between the United States and Europe, responded by driving global stocks lower.

This morning, S&P 500 futures fell 1.12%, an unusually steep drop. The previous trading day ended unchanged. (U.S. markets are closed for Martin Luther King Jr. Day.) The STOXX Europe 600 index fell 1.25% in early trading, and Britain’s FTSE 100 index fell 0.49% before midday. Japan’s Nikkei 225 fell 0.65%. China’s CSI 300 index was flat. India’s NIFTY 50 index fell 0.42%. Bitcoin fell to $93,000. The only major country index to perform well was South Korea, whose KOSPI rose 1.32%.

Gold, a traditional safe-haven investment, hit a new record high of $4,673.4 on the Comex continuous contract.

Wall Street analysts generally agree that President Trump has repeatedly threatened to force Denmark to “Give backGreenland and the imposition of a series of escalating trade tariffs on the UK and EU if those countries fail to comply would be detrimental to global equities. They differ only in their assessment of how bad things could get.

ING’s Carsten Brzeski and Bert Colijn told clients, “Overall, we can only repeat our previous estimate that additional tariffs of 25% could reduce European GDP growth by 0.2 percentage points. However, this model-based estimate certainly cannot capture the full impact of geopolitical tensions arising from new uncertainties and escalating tensions.”

They also warned that “as with previous situations, it’s unclear how this will play out as the White House has yet to release any official word, only Trump’s statement on social media.”

The pair also warned that Trump may be underestimating Europe’s resistance. “While Europe seems determined, at least initially, to resist the latest tariff threat and the US president’s assertion of Greenland, the reality is that Europe remains dependent on the US in many ways from an economic and security perspective. It may be that the EU agreed to a deal with the US last summer that did Europe no good One of the core reasons for the trade deal. Will the new tariff threat and the situation in Greenland be the turning point that finally triggers the emergence of European unity and the emergence of a geopolitical power? But what is clear is that a full-scale trade war between the EU and the United States will only leave losers.”

UBS’s Paul Donovan warned in a morning note that new tariffs could adversely affect U.S. consumers. “The U.S. threatened tariffs appear to be more severe than those related to Iran… which would mean a 4% to 10% increase in U.S. consumer prices for goods from the EU and the U.K. (in about six months). This could reinforce the narrative of a U.S. affordability crisis.”

“Policy uncertainty has returned for U.S. business. This is limiting investment and hiring, but that uncertainty may dissipate as businesses adapt. Uncertainty on this scale could once again put U.S. business activity on hold.”

There is also the question of whether Trump has enough domestic political capital to sustain his desire to conquer Greenland.

“A Reuters/Ipsos poll last week showed that only 17 percent of U.S. citizens support the acquisition of Greenland, and 47 percent oppose it. Only 4 percent support the use of military force, and only 8 percent of Republican voters agree,” Jim Reid and his team at Deutsche Bank Told the client this morning.

Here’s a snapshot of the market ahead of the opening bell in New York this morning:

- S&P 500 Index Futures fell 1.12% this morning. The previous trading day ended unchanged. U.S. markets were closed for Martin Luther King Jr. Day.

- Stoxx Europe 600 Index It fell 1.25% in early trading.

- UK FTSE 100 Index It fell 0.49% in early trading.

- Japan’s Nikkei 225 Index down 0.65%.

- China CSI 300 Very flat.

- Korea Composite Stock Price Index up 1.32%.

- Indian NIFTY 50 down 0.42%.

- Bitcoin It fell to $93,000.