Last year, the fusion energy startup General Fusion struggled to raise funds, it stopped at least 25% of its staff previous received a $22 million lifeline investment while knowing how to keep the company.

Today, General Fusion announced its survival plan: it will go public through a reverse merger with a special purpose acquisition company, Spring Valley IIIcombined with additional investment from institutional investors. It’s a significant change in fortunes for a company whose CEO wrote a public letter last year asking for funding.

If the deal closes as planned, General Fusion could receive up to $335 million from the transaction, more than double what it was rumored to have raised last year before getting a $22 million lifeline.

The transaction will value the combined company at about $1 billion, General Fusion said. Before the merger was announced. The beginning of fusion, which was established in 2002, before raised over $440 millionaccording to PitchBook.

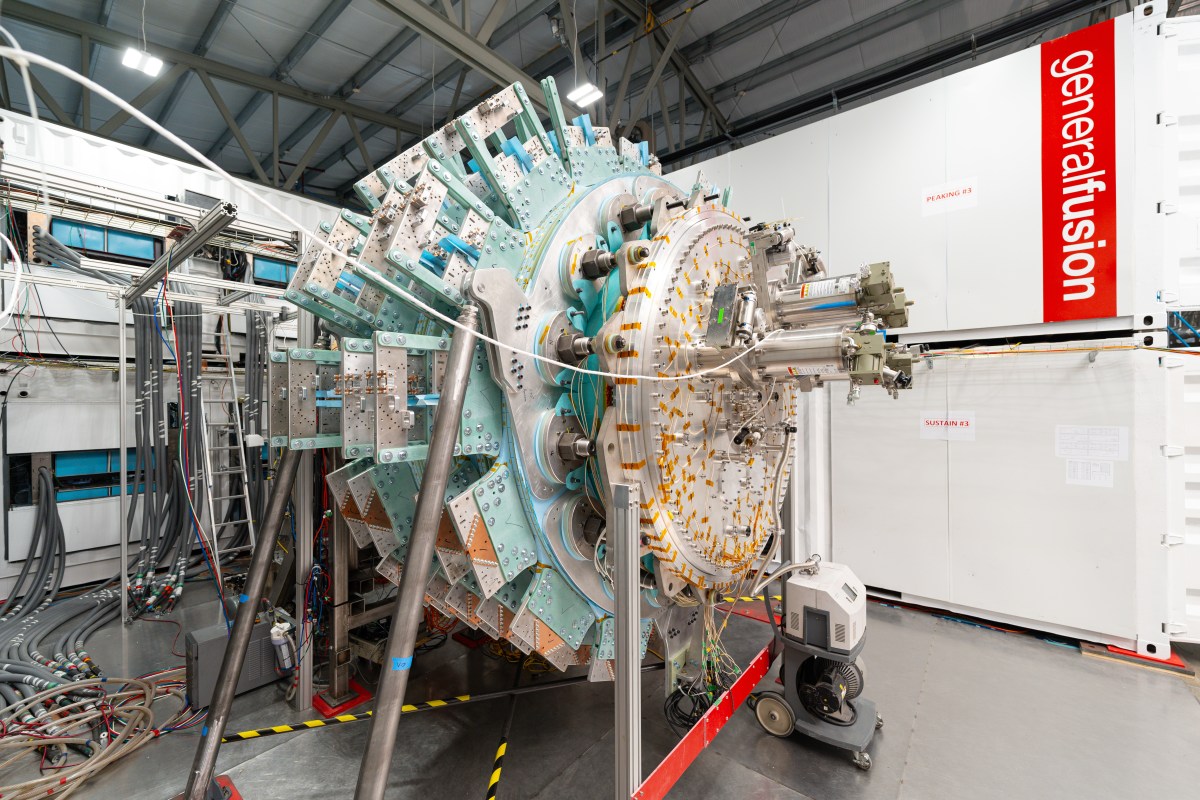

General Fusion plans to use the money to complete a demonstration reactor, Lawson 26 machine (LM26). The device uses an approach called “inertial confinement,” which works by compressing fuel pellets until their atoms fuse together, releasing energy in the process. The National Ignition Facility uses inertial confinement in its successful fusion experimentuse a laser to bombard fuel pellets to unleash compressive forces.

LM26 eschews lasers, though. Instead, it uses steam-driven pistons that push a wall of liquid lithium metal inward to compress the fuel pellets. The liquid lithium then circulates through a heat exchanger, which produces steam to run a generator. By avoiding expensive lasers or superconducting magnets, which are required in other fusion reactor designs, General Fusion hopes to build fusion power plants at a lower cost. But first the company needs to prove the approach works.

Last year, before revealing its financial problems, General Fusion said that by 2026, the LM26 would reach scientific breakeven, where the fusion reaction produces more energy than it needs to start. The scientific breakeven is an important milestone, although it is different and easier to achieve than the commercial breakeven, where the fusion reaction releases enough energy to export electricity to the grid. Fusion Public did not respond to requests asking if the timeline had changed.

Techcrunch event

San Francisco

|

13-15 October 2026

The acquiring company, Spring Valley, is a specialist in the integration of reversers with energy companies. Prior to the takeover of NuScale Power, a small modular nuclear reactor company, public in a deal whose share price has since fallen more than 50% from last year’s peak. The company is also in the midst of completing a merger with Eagle Energy Metals, a uranium mining company that will also develop its own SMR.

General Fusion is not the first fusion company to go public. In December, TAE Technologies announced it would join the Trump Media & Technology Group in a deal valuing the combined company at more than $6 billion.

The common thread connecting these deals is the data center, of course. They are expected to be consumed almost 300% more power in 2035according to BloombergNEF, and General Fusion strongly indicates the rising demand for data center energy in its merger announcement.

But the company also points to broader electrification trends, including EVs and electric heating, which could increase overall electricity demand by 50% by 2035. It’s a reminder that, while the Trump administration has been skeptical about the future of electricity, other countries are moving forward. While General Fusion may face technological challenges, trends in the energy world show that if it can deliver fusion power at a reasonable cost, it will find many willing buyers.