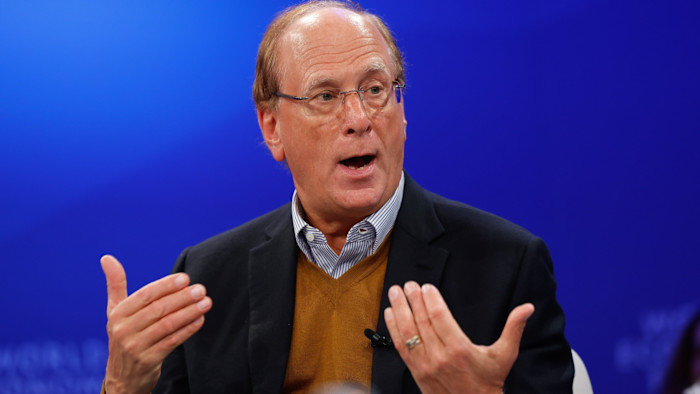

The unusually large and energetic gathering of people in Davos from Monday can be traced back to the persistence – and extensive Rolodex – of one figure: BlackRock chief executive Larry Fink.

Fink, who runs one of Wall Street’s most important financial institutions, is drawing on relationships built over decades to attract heads of state, tech honchos and business executives to an annual gathering that is in danger of falling into irrelevance.

As interim co-chair of the World Economic Forum, Fink’s calls to the White House, which helped secure the attendance of US President Donald Trump, were critical to revitalizing the WEF after a governance scandal threatened the institution last year.

“I have reached many people, heads of state and CEOs with the idea that we are trying to rebuild the trust that is in the legislators, that is in the business leaders, that is in the NGOs,” Fink told the FT in an interview.

This year, nearly 850 top business leaders will attend, including Nvidia Jensen Huanga first-time attendee, Meta’s new president Dina Powell McCormick and JPMorgan Chase’s Jamie Dimon, who will take the stage for the first time in years.

Fink said he sees the Davos conference as a critical forum for world leaders to engage with business, “focusing on how we can build economic prosperity, economic growth that is shared with the wider world”.

“Prosperity has been reduced,” he added. “I think it’s one of the reasons why we have so much polarization.”

He said he hoped to see concrete announcements made after the event, pointing to several side meetings he knew were already in the works, including with senior government figures from Saudi Arabia, Germany and Abu Dhabi.

With nearly 65 heads of state, including most of the G7 countries, in Davos, a key topic of discussion was the reconstruction efforts in Ukraine and the impact of AI. World leaders will also find it hard to ignore the US intervention in Venezuela and Trump’s promise to take “very strong action” on Iran.

The head of BlackRock, in charge $14tn investment for small retirees and the largest sovereign wealth funds, has long played a critical role as Wall Street’s statesman.

BlackRock and Fink became advisers to lawmakers and central bankers during the crisis. The Federal Reserve tapped the New York-headquartered group to manage it bond purchase program in 2020 in the midst of a market that was sold in the first days of the pandemic, and the company played a major role in managing the liquidation of toxic mortgage assets tied to the bailout of insurer AIG in the 2008 crisis.

Fink recently played a key part in helping a BlackRock unit navigate a politically charged acquisition dozens of portsincluding two on each side of the Panama Canal.

But his decision to take in as interim co-chair at the WEF last year gave the 73-year-old a new stage from which to influence world affairs. Fink told the FT he took the role because he believed the gathering would promote global growth and cooperation. Although Davos has been derided by critics as an elite echo chamber, Fink says the importance of bringing leaders together has been overlooked.

“We live in a more polarizing world. There are a lot of people talking to each other, not to each other,” he said. “I’m not here to tell you (the WEF) is perfect. But I think we need to stop getting bogged down by these assertions of what it is and see what it is.”

His success in wooing Trump on only his second visit as president helped boost demand for the gathering. other leadersbut Fink insists it’s “an unfair understatement” to say Davos will be “a Trump show.

“It’s my job to raise everyone up and have a serious conversation.”

The WEF itself is still finding its footing after a tumultuous chapter under the leadership of Klaus Schwab in which the organization was rocked by allegations of financial misconduct and a toxic work environment. An investigation cleared Schwab of allegations of misconduct. Fink and Roche vice-chair André Hoffmann have headed the WEF’s governing board since August.

Fink, a WEF board member since 2019, said he took the role expecting to lead for two years or less and then be handed a permanent seat. The president of the European Central Bank Christine Lagarde is seen as a possible opponent for that position.

Fink said it’s “very good” that Lagarde will be the candidate if a search committee eventually convenes.

“If the governing board believes that when his (ECB) term is over that he should be a candidate, I think it’s fantastic. He’s a qualified person,” he said, adding that Lagarde was a personal friend.

Fink’s enthusiasm impressed WEF staff who worried he might become a figurehead. “He has used his influence especially in Silicon Valley, which has avoided the WEF in recent years, to come,” said a WEF executive.

Fink combined interest in the summit with his usual world travels and corporate meetings in the months leading up to the forum.

“Actually he seems to enjoy it and enjoy the role to the surprise of some people. I think at the beginning some of us were worried about him being too busy with BlackRock but this is not the case,” said a person based in Switzerland familiar with the organization of the discussions.

Fink, who founded BlackRock in 1988, said he had similar fears. But after discussing the time commitment with the BlackRock board, he believes some of the asset managers may step in to help lead the company as he focuses on rebuilding WEF.

“I don’t even know if I have the capacity to do it,” he said. “In consultation with my leadership and my board, they thought it was something that my other leaders could fill in more and more for the time I needed to make sure we rebuilt the World Economic Forum as a place for conversation.”