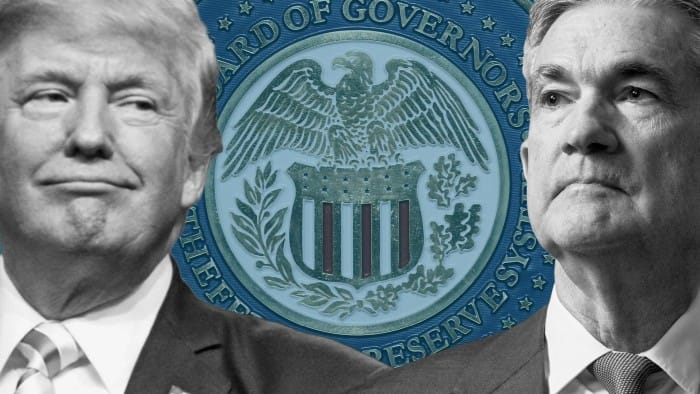

Since Donald Trump’s Election Victory Last Year, Federal Reserve Officials have pursued a strategy of sticking to their knitting alongside concessions in areas peripheral to the central bank’s core functions.

Fed removes pages from its website to differentiation, uniformity and participation, which seat Jay Powell said “align our policies with executive orders”, taken from The International Central Central Bank Network for planting financial system and clear refused to comment on merits of tariffs.

Michael Barr, the Vice-Chairman of the Fed for the management, announcing that he descended from that role to allow the President to choose his own choice and last week was explained He doesn’t want to be a “disruption” to “put Fed on the cross”.

In large issues, Powell is proud to be the President cannot be firmly firm neither are members of the Board of Governors and the independence of the central bank is of interest in the US economy.

So far Trump is calling for Fed to cut interest rates but not trying to interfere directly. His sidekick, Elon Mok, said last week he wanted Audit the Fed without being exposed. An unstoppable calm will improve.

In November I was afraid I was in the first Fed threatsSo now, I look at the relevant evidence and ask the question, if Trump wants to be controlled, what does it die independence? Results are not fully credited.

The personnel placed

The preferred method of autocrats around the world are the items of central banks with flunkies to make their bidding. The standard view is that it is difficult for the US president. The office terms for the board of governors of the Fed have adriana kugler and jay powell falling falling for the next four years.

the Federal Reserve Act It is said that governors can only get to the President “for the reason”, which means they need to make serious mistakes of duty.

Don’t let these facts prevent you from.

On February 12, Sarah Harris, the acting Solicitor-General, wrote to Senator Richard DurbinThat declares that the Department of Justice does not believe this “cause” the provisions of constitution and “the department no longer protect their constitutional”.

He specifically mentions the Federal Trade Commission, members of the National Labor Labors and members of the consumer Safety Commentice Commission, but also included by independent agencies “with” many executive power “.

This issue is the Supreme Court about firing the Hampton Dellinger, head of the United States office of special advice. The reasonableness delayed a decision on Friday. The more relevant to the fed position is Trump’s sack of Gwynne Wilcox, sitting at the National Labor Relations board. He also suffers.

The Supreme Court has violated “for the cause of” protections for agencies with someone in charge. Legal scholars suggest that there is a good opportunity The majority of the court to prevent this long time before members of the member of government agencies, which empowers the Fed members.

To a Unique paper In the legal position of the Fed, Professor Daniel Tarullo in Harvard Law School, a Fed member, if the Supreme Court of Governers to remove participation in many other crossharip agencies next constitutional challenges “.

We do not know if Trump’s court succeeded in court and, if so, if the board members also fired, but personnel of the persona are already in other federal agencies.

The Great Great Covenant

A second weakness in the Fed Constitutional position that concerns the presidents of the region that seated the Federal Open Market Committee.

For their position to be constitutional, Tarullo argues that they have finally considered the “lowest officer” in the US because they are not taught by the President and proved by the Senate. it the view of the legal advice office In 2019, as Tarullo said, “reaching out this conclusion took some”.

Problem is that setting interest in interest is a more powerful position than most and certainly stronger than other lower officers. Voting against most fed board (an 8-4 votes are said if most of the provicors of the board of Govery have lost limits of constitutional officers. The board can turn off the lower Officers and push their view at a special meeting, but, as Tarullo said, situations like this “no way to run a central bank”.

This issue cannot now live, but things change.

Deduction Directive

The most direct challenge of the Fed’s authority comes when Trump decided to challenge the ability to take the decisions independent of his view under Congress.

On its website FED states undoubtedly That its board “guides the operation of the Federal Reserve System to improve the responsibilities and fulfill the responsibilities given by the Federal Reserve Act”, and that it is “a Federal Reserve Agency Access to Congress”.

But this position is under direct threat from Trump thanks to two executive orders he signed last week, trying to bring the agencies under his control. The first one It is said that “the officials who use many executive power must be guarded and controlled by the People’s Selected President”.

Fed regulatory powers are specified in order, even if there is an engravings for money policy. But if this executive order to keep inevitable court challenges, which carving cannot be greater.

It is an area of many insecurities in strong security. Congress allowed under a 90-year-old leading delegate power as long as it gives a “Since the ever“For agencies to operate. Art Second executive command Wednesday intends to attack it directly, seeking to eliminate “regulations based on unlawful power”.

Tarullo thinks that the double-command of the Fed is likely to be weak here because the double command of solid price and The maximum job can be contradictory and therefore not a wisdom principle. The application of the most recent Supreme Court is here, he wrote, “suggestion (s), if not large, problems for the Federal Reserve Act”.

Since Tarullo wrote his view last year, I caught him yesterday to get his view where the maneuvers last days left the Fed.

Professor Tarullo said there was no doubt that these issues would be litigate and the case of view was in Wilcox, shot from NLRB. If his protection is considered non-constitutional, “every independent agency is called the question”. Fed may have some special arguments why it is different or the NLRB case can be described, he says (was designed by his paper), but a direct search in the Supreme Court has questions about the fed’s constitutional connection.

Thus, Tarullo saw a little bit wanted from the new administration to attack the Fed. “It is self-interested in administration that does not suggest to move Jay Powell or other governors. They seem to understand that,” he said. But efforts to separate money policy from financial regulation in many gray areas such as dismissing banks in the replace of replace -iil to first urge to replace the first urge to replace the first prompt to replace the first prompt to replace the first Prompt to replace the first prompt.

It can only be in the financial market reaction when Trump decided to strike.

Fate Fate

Speaking of things set ready for Chop, the Federal Open Market Committee gave notice In those days counted for flexible average inflation targeting (Fait).

Fait introduced to Fed’s Statement of more run-run goals and strategies of money policy After a 2019-20 review and stated that pigs seek to run inflation moderate heat at a time “following the periods when inflation is running below 2 percent”.

In minutes, officials learned that the economy has changed mostly since 2020 and wants this review of elements indicated later. The most important change highlighted is the “method of pursuit to achieve inflation at a maximum of 2 percent after periods of persistent inflation”.

The fate of the fait is sealed.

My reading and watching

Disappearance Mount ECB As to pay the interest paid to bank reserves (to place a night of interest in interest) higher than the yield of bonds purchased in the lower christmas program. Because losses are not immediately recognized and offset new capital unlike UK, ECB does not pay parts of states that come

Also in Frankfurt Isabel Schnabel, a member of Ecewibo in the ECB, gave a Interact with Hawkish to ft. Full transcript

When will the US Bond Bond Market rise against leisure Ladesse? Not good forwards? “It is, until no,” Mark Solbel, the former Treasury officer in the US, tells FT to a large reading Your time is good

And if you want charts, check the bicycle visually In the first month of Donald Trump’s second

A chart that matters

Corporate revenue calls are a great option source to fast information that promotes concerns to companies. In recent weeks, the number of sentences linking trade with a corporation shot in the US (chart below) and again in other countries, especially in Mexico and Canada.

Taking care of business investment in front of trade uncertainty is a huge risk of global economy at this year. We can only see if executive concerns are to interpret lower spending.