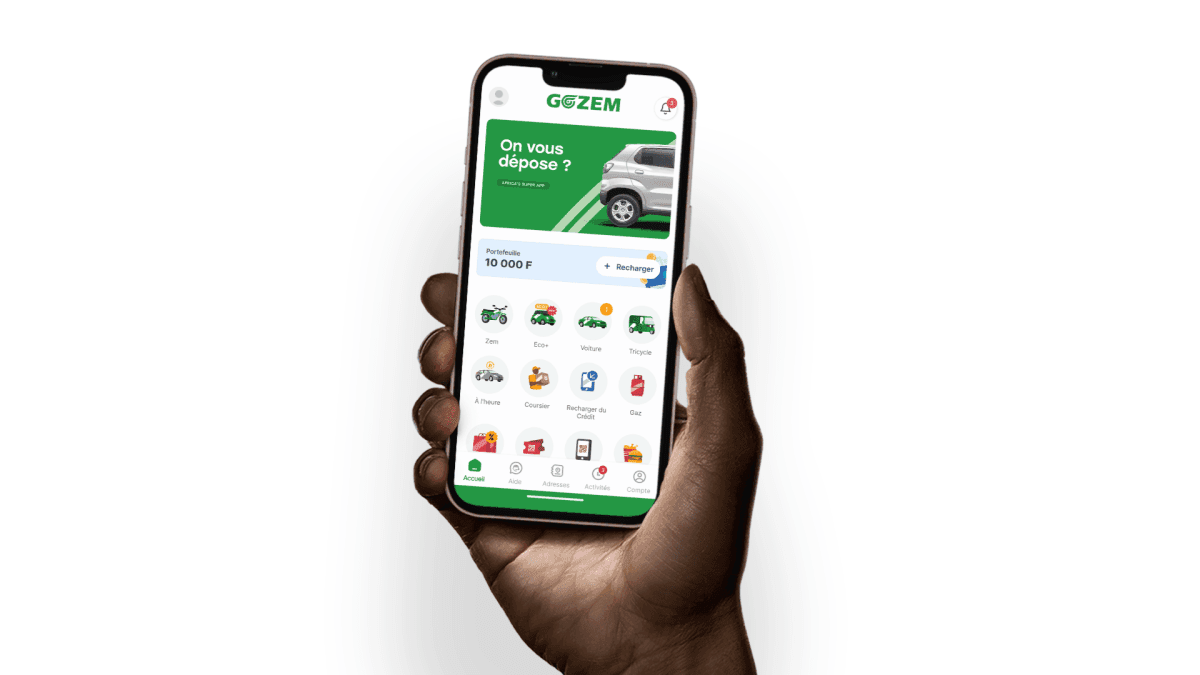

Began to launch in 2018 as a service riding in Togo, Cum It has been continuously expanded throughout the West Afternite Africa, incorporate various services because they are looking for super-apps. The company currently offers haiishing rides, trade, vehicle financing, and digital banks in Togo, Benin, Gabon, and Cameroon.

Now, on the offer for the ecosystem scale, Gozem has raised $ 30 million in a series of B – $ 15 million in debt and debt $ 15 million – led Al Mada. The company will use the fund to destroy the vehicle’s establishment service, and the fashion to the new market.

By the founder of the opening Gregory Costamagna and Raphael FundGozem set apart from the platforms and other vehicles by ensuring the driver’s financial and can access Career growth opportunities.

Goze gown stack cover motor, wheels and cars, when financial products are denoted to help the drivers buy drivers. It also allows the workers to create a wholesale food and grocery as part of the e-commerce business.

“The main client is a professional driver,” Costamagna tells the techcrroch. “We build the ecosystem to help drivers get more money and bloom in life. If they succeed, the business is all successful.”

When We cover $ 5 million gozem series in 2021It has only chosen vehicle financial models, cargo with local bank and spread over 1,500 vehicles in the year. Therefore, the company has been collaborated with international international and international company (IFC) and current financing for about 7,000 vehicles.

To pull drivers on the platform, the company purchased the vehicle with a mixture of debt and effort, and the driver can pay this vehicle. Instead of requires a deposited up, gozem recovered the cost over small pieces of every driver’s income. Uber-made Moove, Asaak and Max It also offers vehicle financial products to the driver in different markets.

Gozem says that the program guarantees the payment is relatively relatively relative to the driver’s income.

“We explained to all the driver that this is a long term trip,” Costamagna said. “We finance the motor, (but then it can be upgrading to (the three-wheeled people), then the car, finally becomes a full vehicle owner.”

The Founder said that the outstanding part of the debt is directed to be released for a vertical gozel builder. The company also worked to raise $ 20 million more in the weeks that will come to support an expansion throughout African francophone for the next two years.

Super-App rotation

Many of the lost platforms and mobility has tried to join different services in a super single application, but the model is not always successful. In Sub-Saharan Africa, for example, the application of the payment that has tried to develop into a super app, like softbank made Opayhave seen success.

Gozem, however, see traction thanks to the same approach to Southeast Asian and giants riding rain and gojeges. Some competitors, as Bond-backed Yasir and MNT-HalanIt also explore the same model in Africa across the Maghreb and Egyptian region for some success.

Now, the company has a 10,000 driver registered, and more than a million users use the platform so far. Speaking of users each month in hundreds of thousands.

In addition to core, gozem has seen some growth in digital tickets, which is the division of the trade. The company sells the event ticket through the market, and says that it has processed more than 50,000 tickets in the Togo only for the main concerts and events.

This company is also horrible digital banking bank (a gozem money) through MONEX Acquisition In 2023. Service, now live in Togo, allow users to make mobile payments, and according to companies, millions of dollars per day.

Prior to this latest series, Gozem records the value of the $ 50 million values across three vertical products. Funds say that the company expects the triple or quadruple grow in 2025 with new capital.

He noted that the circle series imagined a gozem model, due to industrial and financial services investors joined the lid table. Sas Saving Agencinges Services are part of the MSC group, one of African’s largest container terminal operators as the PAN-african conglomerate effort of Al Mada.

“Whether validation because we have an investor that operating on the ground in the same market where we operate,” says funds.