a Dubai-based restaurant reservation startup Eating application It aims to make India a business focal point with new fundraising, acquisitions, and partnering with Swiggy to sell solutions to restaurants to collect reservation data and grow their business based on it.

The company said it has raised $10 million in a Series B extension round led by PSG Equity through portfolio company Zenchef SAS. In particular, this amount is greater than the original series B of $6 million in 2022. With this fundraising, Eat App has now raised more than $23 million in funding so far.

The company, which has been around for more than a decade, has a presence in more than 92 countries, serving more than 5,000 restaurants and $12 million in ARR. However, in the last 12 months, India has become a major focus for the company as it scaled over 2,000 restaurants in the country.

India’s food service industry is set to be worth more than $85 billion by 2028, according to industry reportwith dine-in making up more than half of that. Restaurants rely on walk-ins and manage reservations separately from sources like Zomato, Swiggy, and EazyDiner.

To gain scale, Eat App acquired a so-called competitor ReserveGo and also cooperate with recently listed food and grocery platforms, Swiggyto upsell restaurant products.

ReserveGo was founded by Vijayan Parthasarathy in 2022. Parthasarathy has a history in the restaurant reservation industry. Before ReserveGo, they built a similar platform called Inrestro in 2014, ie was acquired by Times Internet Dineout in 2015. In 2022, Swiggy got it Dineout from Times Internet.

Eat App acquired ReverseGo in mid-2025, which served more than 1,000 restaurants at the time. Parthasarathy told TechCrunch that the platform has handled an average of 5 million reservations per month for the past 12 months without any hiccups.

Techcrunch event

San Francisco

|

13-15 October 2026

EatApp has also partnered with Swiggy to market its products to restaurants for sales, which has reached a total of more than 2,000 restaurants for the startup, with more than 8 million covers served by the end of the year through various platforms. In comparison, Swiggy’s own Dineout platform is already complete 23.8 million in 2025.

“There has never been a more exciting time for the restaurant industry in the country, with consumer adoption and constant innovation. We believe access to Eat App’s world-class technology and AI-driven tools will improve restaurant management, helping restaurants across the country bring a more enjoyable experience to their guests,” said Arpit Mathur, Vice President of Strategy at Swiggy, in a statement.

The company, which listed on the Indian market last year, said it has partnered with Eat App to bring global solutions for restaurants to grow their business.

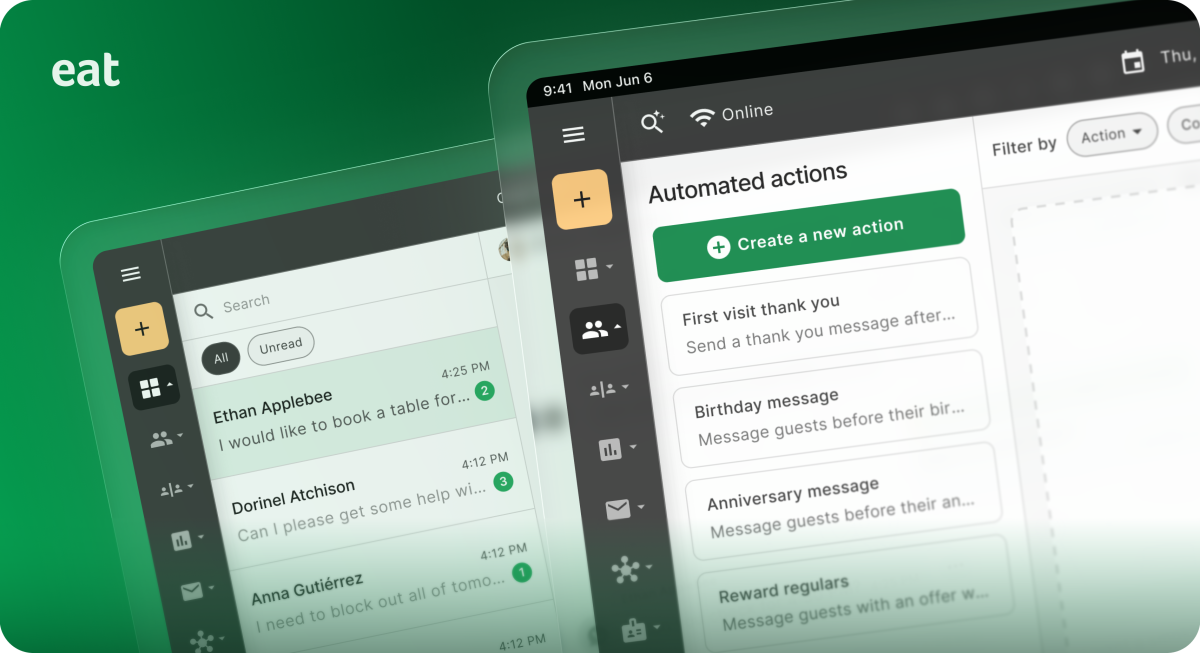

Swiggy and EatApp market this solution as GroMax for India, which includes additional features such as the ability to promote restaurants on Meta and Swiggy, apart from reservation management. While Swiggy is not involved in product development, the sales team provides input to Eat App on potential features that can be developed for the market.

Before India’s expansion, the United Arab Emirates (UAE) was the largest market, followed by the US, UK, and Saudi Arabia.

“Honestly, as we see India, there are very strong synergies and similarities between what we saw in the (GCC) region eight, nine years ago, especially in Dubai, where we were the first, I would say, we were responsible for building that scaffolding, that layer of technological infrastructure (to serve restaurants). And we see a lot of similarities in India.

“We hope that whatever efforts are made in areas in Dubai and where restaurants have equipment now, we can serve the same in India together with local founders like Vijayan and his team to help us lead the change in India,” he said.

India is a market with huge opportunities in the restaurant space. However, for restaurants, the challenge is to attract customers using every possible channel and then collect those reservations in one place. Parthasarathy noted that the top 200 restaurants in India are only available to customers through reservation. But for the next few thousand it’s a lot about capacity management through different channels.

The growth of Eat App faces several obstacles. First, there are international competitors such as Seven Rooms, TableCheck, and OpenTable, along with local ones like PetPooja and Posist. Second, some restaurants just walk around or don’t use aggregation software to get data about their visitors.

Some TechCrunch industry executives say reservation aggregation software as a standalone product won’t entice restaurant owners. Eat App needs to prove that its growth suite brings enough value to restaurants.