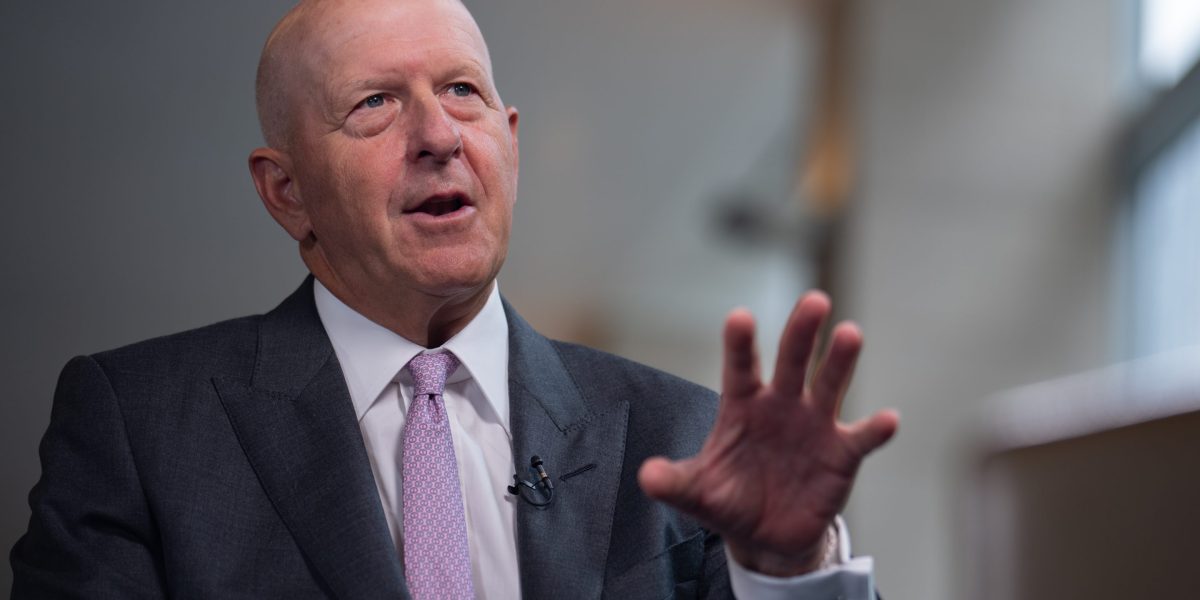

Goldman Sachs Chairman and CEO David Solomon has issued a firm rebuttal to doomsayers as concerns grow that artificial intelligence is ushering in an era of “jobless growth.” In January, amid a wave of massive capital investment in artificial intelligence infrastructure, Solomon insisted the labor market was not facing disaster.

“I’m not in the career doom camp,” Solomon told reporters Goldman Sachs Exchange Podcast that rejects claims that the current wave of technology poses a fundamental threat to human employment.

Solomon acknowledged that the labor market looks fragile relative to recent economic growth, but he argued that the current disruption is more of a normal course. creative destructionrather than being structurally unique.

“Technology has been disrupting employment for decades, changing the way people work, destroying jobs and forcing us as a dynamic economy to create new jobs,” he said. “This time is no different,” he said.

He cited research by Goldman Sachs chief economist Jane Hartius, noting that while short-term disruptions are inevitable due to the pace of change, there is no evidence that long-term unemployment is structurally higher.

Reinventing the company: a GS 3.0

Applying this philosophy to his own bank, Solomon detailed a new initiative called “One GS 3.0.” Solomon describes the initiative as an effort to “reimagine” six core processes such as onboarding and know your customer (KYC) through automation and white paper redesign, and is anything but a layoff strategy.

“We think (these processes) could really benefit from a novel white paper look and automation,” he said, “because the technology that exists today allows us to do them differently.”

Solomon said that the goal of Goldman Sachs’ artificial intelligence integration is not to lay off employees, but to expand production capacity. “If we do it right, I don’t think it’s going to significantly reduce our numbers,” Solomon said. Instead, increased efficiency will provide the company with “the ability to invest in growth” that it previously lacked due to constraints.

However, the CEO admitted the transition was difficult. While employees are quick to adopt productivity tools that make them “smarter,” overhauling traditional workflows like KYC is a daunting task. “Changing processes in large enterprises is hard work. It takes some time,” he warned, noting that the friction involves fundamentally changing “the human capital we use in the process.”

Solomon’s comments are consistent with recent research by Wharton professor Peter Cappelli, who Tell wealth earlier this month Artificial intelligence adoption is neither cheap nor easy, nor is it a guaranteed path to layoffs. In one case, a company called Ricoh adopted AI and tripled productivity, but it took a year to break even due to monthly operating costs of $200,000 and upfront consulting fees of $500,000.

“It wasn’t cheap and it took a long time to do,” Cappelli said.

A reality check on speed

Despite Solomon’s long-term optimism, he made a modest prediction for the pace of AI adoption in the corporate world through 2026. While denying that the AI topic is “losing steam” – calling it an “incredible technology” – he predicted that expectations could be reset in the year ahead.

“It will continue to accelerate,” Solomon predicted. “The pace of capital investment is going to continue. Whether the demand and usage of computing is going to be as fast as people expect it to be now, whether people can bring it into the enterprise as quickly as they want it to be, I think that’s where you could see a realignment this year.”

Solomon added that by some time in 2026, there may be widespread recognition that deploying AI in enterprises will be more difficult than initially thought. As a result, implementation may be “slower than people think now” as companies grapple with the complexities of integration.

On the first day of the World Economic Forum Annual Meeting in Davos, Switzerland, Microsoft CEO Satya Nadella A similar tone sounded. Nadella acknowledged for the first time that the AI story is likely to become a bubble and that it has almost nothing to do with tech companies.

“If we’re just talking about tech companies, that’s a clear sign of whether there’s a bubble,” Nadella told World Economic Forum interim co-chair Larry Fink. “If we’re just talking about what’s happening on the technology side, then it’s just purely the supply side.” From the demand side, he argued, adoption must be widespread and successful, much like the computing revolution of the 1980s.

“We invented this category of things called knowledge work, where people started really using computers to amplify what we were trying to achieve with software,” he said. “I think the same thing will happen in the context of artificial intelligence.”

Solomon’s remarks came against the backdrop of “a huge boom in capital investment in artificial intelligence infrastructure,” which he believes is a key pillar of a supportive macro environment in 2026. He said he remains optimistic about the productivity gains AI will bring, not just in finance but also in areas such as health care.

“I think the opportunity is expanding right now, not contracting,” Solomon concluded. He pointed to the potential of technology to change the outcomes of disease and cancer treatments as reason for optimism that the global economy has entered a “growth-oriented period.”

In this regard, Solomon sounds like NVIDIA In an interview with Fink in Davos, CEO Jensen Huang dismissed concerns about an AI bubble, citing “the largest infrastructure buildout in human history” as the backdrop. Huang Renxun believes that the artificial intelligence industry is a “five-layer cake” that requires thorough industrial transformation. The bottom layer is energy, and the second layer is chips such as NVIDIA GPUs. Next are cloud infrastructure, models, and applications respectively. If you believe in this new layer cake structure, the opportunities keep expanding, as Solomon & Wong apparently do.