Unlock Editor’s Digest for free

Roula Khalaf, Editor of the FT, selects her favorite stories in this weekly newsletter.

Intel shares fell as much as 12 percent on Thursday after the U.S. chipmaker provided a downbeat earnings outlook linked to issues with the launch of new manufacturing technology that is key to its turnaround effort.

The Santa Clara, California-based company said it expected between $11.7bn and $12.7bn in revenue for the quarter ended in March, beating Wall Street expectations of $12.6bn.

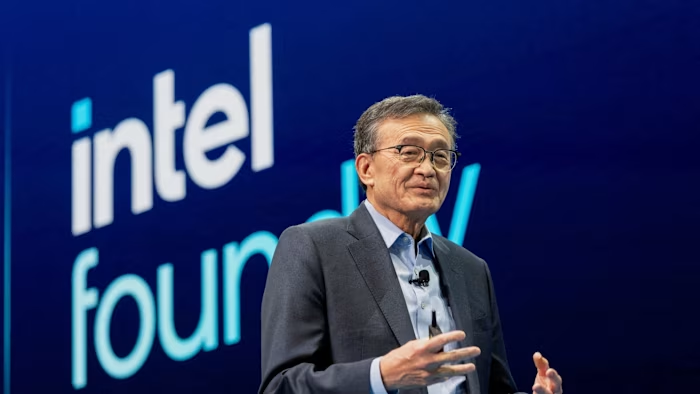

Chief executive Lip-Bu Tan said he was “disappointed that we cannot fully meet the needs of our markets”.

He said the company was “aggressively working to increase supply to meet strong customer demand” – and hailed the launch of the new personal computer chip as an “important milestone”.

Intel Shares fell sharply in after-market trading in New York, even though the company reported revenue of $13.7bn in the quarter to the end of December, slightly ahead of Wall Street expectations of $13.4bn compiled by Visible Alpha.

The stock has rallied nearly 50 percent this year ahead of Thursday’s earnings report thanks to President Donald Trump’s backing and optimism around the new Panther Lake PC chip.

But it is facing intense pressure to turn around its manufacturing business after pouring billions of dollars into trying to regain its position as the only US company capable of making the world’s most advanced chips, including those used for AI.

Intel acknowledged a surge in demand late last year, particularly for chips used in data centers, hurt the company. It is also struggling to establish its new manufacturing process for high-end chips, known as 18A, which is a key stepping stone to complete its transformation.

The chipmaker is trying to increase the “yield” from 18A – the percentage of functional chips operating on the production lines.

Tan admitted that “while the yields are in line with our internal plans, they are still below what I want.”

The 18A rollout has pushed up costs for the company in the short term, although Intel says costs should fall as it begins to produce chips on a larger scale.

Intel’s chief, who took over last year, has warned it could scrap its next-generation manufacturing technology, known as 14A, unless it is confident of securing major customers such as Apple and Qualcomm.

On Thursday’s call with analysts, he struck an upbeat tone, mentioning that a couple of “big customers” are in the process of testing 14A.

Tan told analysts that he believes clients for 14A “will start making firm supply decisions starting in the second half of this year…

Intel’s efforts to provide a US alternative to Taiwan Semiconductor Manufacturing Company as a manufacturer of advanced chips at the heart of the AI race have earned it support from the White House.

Trump celebrated the launch of the US-made Panther Lake chip earlier this month and said the government made “tens of billions of dollars” from the 10 percent stake Intel agreed to take in August.

After the US took a stake, Intel also got $2bn from SoftBank and a $5bn investment from Nvidia, which Intel said closed in the quarter.

Intel’s chip-making business, known as the foundry, had $4.5bn in revenue, above the $4.2bn expected.

The group reported a net loss attributable to shareholders of $591 million for the December quarter – worse than consensus estimates.

Intel also suffers from capacity limitations at TSMC, which the US group still relies on to make some of its chips.

Disadvantages of memory chips too biting the entire industry while AI data center builders are gobbling up limited supply from a few key players – Micron, Samsung and SK Hynix.

Intel’s product division, which includes the PC and traditional non-AI data center chip business – and represents the majority of its revenue – reported $12.9bn in revenue for the quarter, ahead of the $12.7bn analysts had predicted. It continues to face tough competition in the PC chip design business from the likes of AMD and Qualcomm.