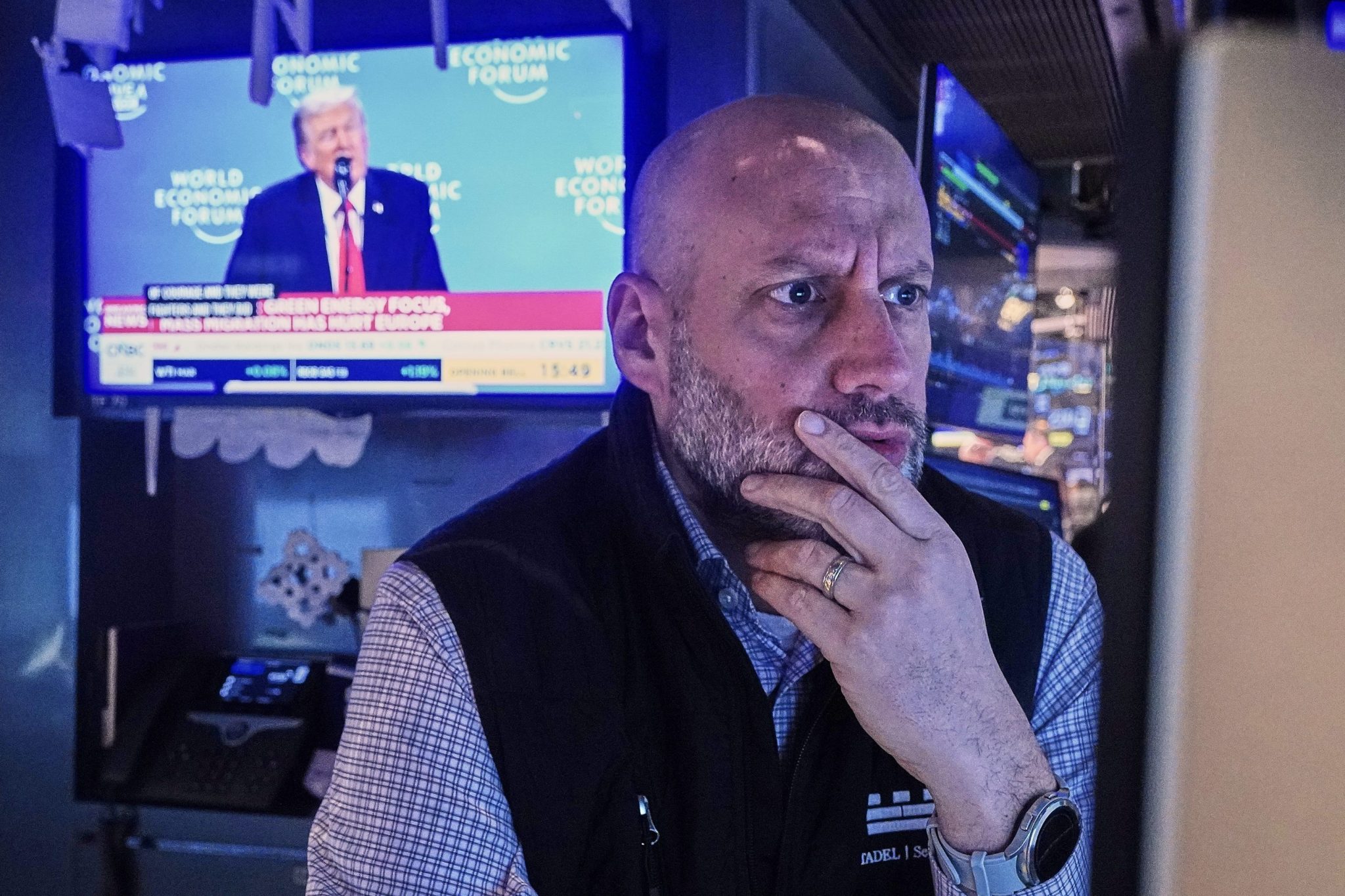

U.S. stocks rebound from highs Worst day since October after wednesday president donald trump He said he had reached a framework for an agreement on Greenland, the island he had long coveted, and would not impose the tariffs he had threatened on several European countries.

Trump said the deal “if completed, would be a great thing for the United States and its allies in the North Atlantic region,” and the S&P 500 rose 1.2%. The news triggered an immediate move higher for stocks, which took comfort early in the day after Trump’s election gradually reduce his rhetoric And he told European business and government leaders that he would not use force to seize “the ice.”

The easing of tensions helped the S&P 500 recover more than half of the previous day’s 2.1% loss and move closer to its peak levels. all time high It was set earlier this month. this Dow Chemical The Jones Industrial Average rose 588 points, or 1.2%, Nasdaq The composite index rose 1.2%.

Treasury yields also fell in the bond market, another sign that investor concerns are easing. In addition to progress in Greenland, they have been helped by stabilizing yields in Japan’s volatile bond market. Meanwhile, the U.S. dollar recovered some of its losses against other currencies after falling the previous day.

Trump himself acknowledged that U.S. stocks sold off on Tuesday due to his desire for Greenland, but he called it “minimal compared to the gains in the first year of his second term” and suggested further gains were to come.

Trump has a history of issuing major threats that sent financial markets sliding, only to later backtrack and strike deals that would have less of an impact on the economy or inflation than he originally suggested.

On the one hand, this pattern has spawned the acronym “TACO,” suggesting that “Trump will always back down” if financial markets react strongly enough. Trump, on the other hand, ended up making a deal that outsiders might have thought was unlikely, only to trumpet it later. The most obvious example was Trump’s announcement of high tariffs on Liberation Day, which ultimately led to trade deals with many of the world’s major economies.

Helping lead U.S. stocks on Wednesday were halliburton. The oilfield services company reported its latest quarterly profit was stronger than analysts expected, sending its shares up 4.1%.

United Airlines shares rose 2.2% after the airline also reported profit for the final three months of 2025 that beat analysts’ expectations. CEO Scott Kirby The airline’s revenue momentum will continue into 2026, it said.

They helped offset a 2.2% decline Netflix. The company fell despite reporting a higher-than-expected profit. Investors turn to User growth slows and a lower-than-expected profit forecast for the current quarter.

Kraft Heinz It then fell 5.7% Berkshire Hathaway warns investors it may be interested Sold 325 million of its shares The food giant that former CEO Warren Buffett helped create in 2015.

Berkshire took Writedown of $3.76 billion It took a stake in Kraft Heinz last summer. Buffett said last fall he was disappointed with Kraft Heinz Plan to split the company Twice, two representatives of Berkshire resigned from Kraft’s board last spring.

All told, the S&P 500 rose 78.76 points to 6,875.62. The Dow Jones Industrial Average rose 588.64 points to 49,077.23, and the Nasdaq Composite rose 270.50 points to 23,224.82.

In the bond market, the 10-year Treasury yield fell to 4.25% from 4.30% Tuesday night. That’s almost back to Friday’s level of 4.24%.

That was after Trump threatened to levy 10% tariff Denmark, Norway, Sweden, Germany, France, the United Kingdom, the Netherlands and Finland oppose U.S. control of Greenland. This is in addition to the 15% tariffs set out in a yet-to-be-ratified trade deal with the EU.

In foreign stock markets, European and Asian stock indexes were mixed, with mostly moderate trends.

Japan’s Nikkei 225 fell 0.4%.

The country’s Prime Minister Sanae Takaichi has early election February 8, long-term government bond yields record level and triggered concerns in global financial markets. Capitalizing on strong public support, the government is expected to cut taxes and increase spending, adding to the government’s already heavy debt burden.

Japan’s 40-year government bond yield fell back to 4.05% on Wednesday after soaring to 4.22% on Tuesday.

___

AP Business Writers Chen Haoqian and Matt Ott contributed.