The OECD announced on Monday that nearly 150 countries had agreed on the plan, originally developed in 2021, to stop large multinationals from shifting profits to low-tax countries, no matter where in the world they operate.

The revised version, which follows negotiations between President Donald Trump’s administration and other wealthy G7 countries, excludes large U.S.-based multinationals from the world’s lowest tax rate of 15 percent.

OECD Secretary-General Matthias Coleman said in a statement that the agreement was a “landmark decision in international tax cooperation” that “enhances tax certainty, reduces complexity and protects the tax base.”

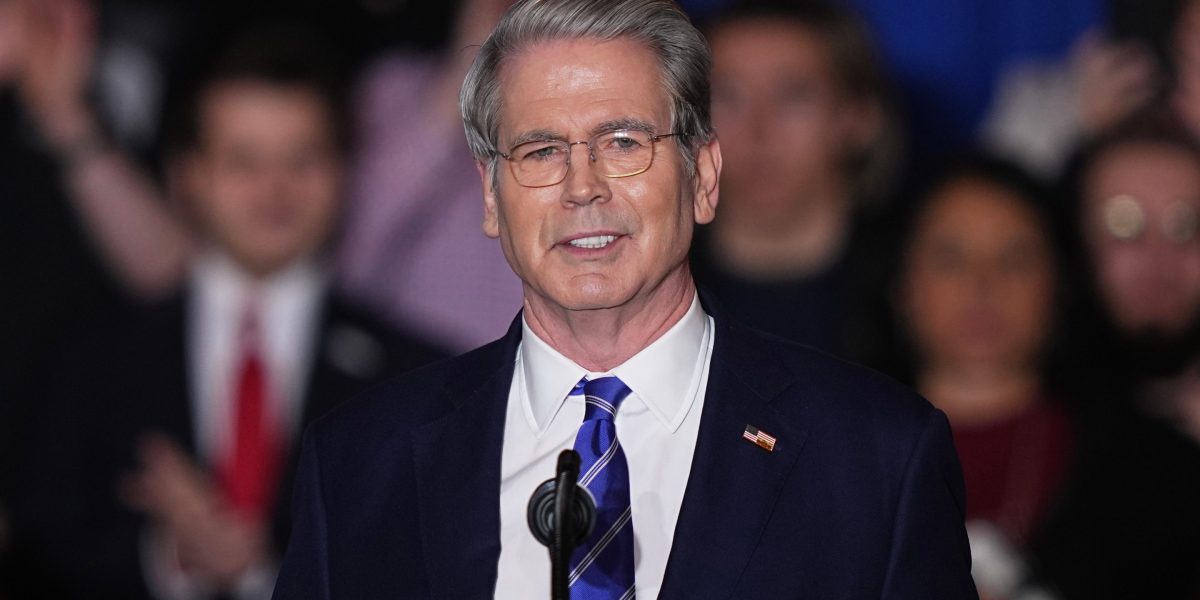

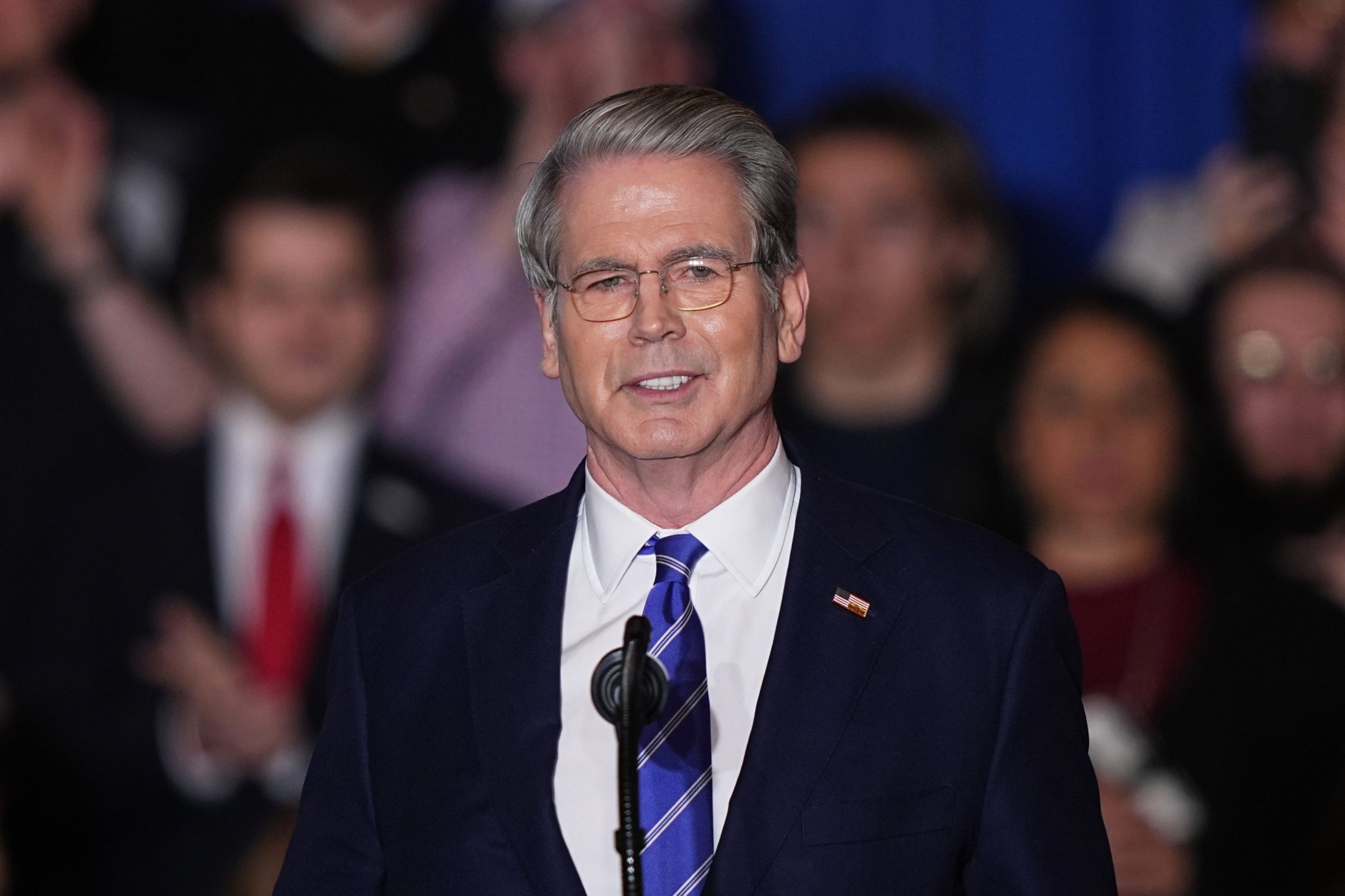

U.S. Treasury Secretary Scott Bessant called the agreement “a historic victory to preserve U.S. sovereignty and protect American workers and businesses from extraterritorial overreach.”

The latest version of the agreement downplays a landmark 2021 deal that set a minimum global corporate tax of 15%. The idea is to deter multinational companies, including apple and Nikeusing accounting and legal tricks to move income to low-tax or tax-free havens.

These safe havens are often places like Bermuda and the Cayman Islands, where these companies actually have little or no business.

Former Treasury Secretary Janet Yellen Key drivers 2021 OECD Global Tax Agreement and made corporate minimum tax One of her top priorities. The plan has been widely criticized by congressional Republicans, who say it will weaken U.S. competitiveness in the global economy.

this Trump administration In June, the two sides renegotiated an agreement when congressional Republicans withdrew from it So-called retaliatory tax provisions from Trump’s huge tax and spending bill This would allow the federal government to tax companies with foreign owners and investors from countries deemed to impose “unfair foreign taxes” on U.S. companies.

Tax transparency groups criticized the OECD’s revised plan.

“This deal risks nearly a decade of global corporate tax progress and will only allow the largest, most profitable U.S. companies to park their profits in tax havens,” said Zorka Milin, policy director at the tax transparency nonprofit FACT Coalition.

Tax regulators argue that a minimum tax should deter international corporate tax competition, which leads multinationals to book profits in low-tax countries.

Congressional Republicans applauded the final deal. “Today marks another important milestone in ‘America First’ and unwinding the Biden administration’s unilateral global tax rebate policy,” Senate Finance Committee Chairman Mike Crapo, R-Idaho, and House Ways and Means Committee Chairman Jason Smith, R-Mo., said in a joint statement.