Uber reports strong business growth Third quarter earnings report But earnings fell on Wednesday after taking a $479 million charge over what the company said were undisclosed legal and regulatory issues. The hit to profitability overshadowed a quarter that saw one of the largest growth in rides in the ride-hailing giant’s history.

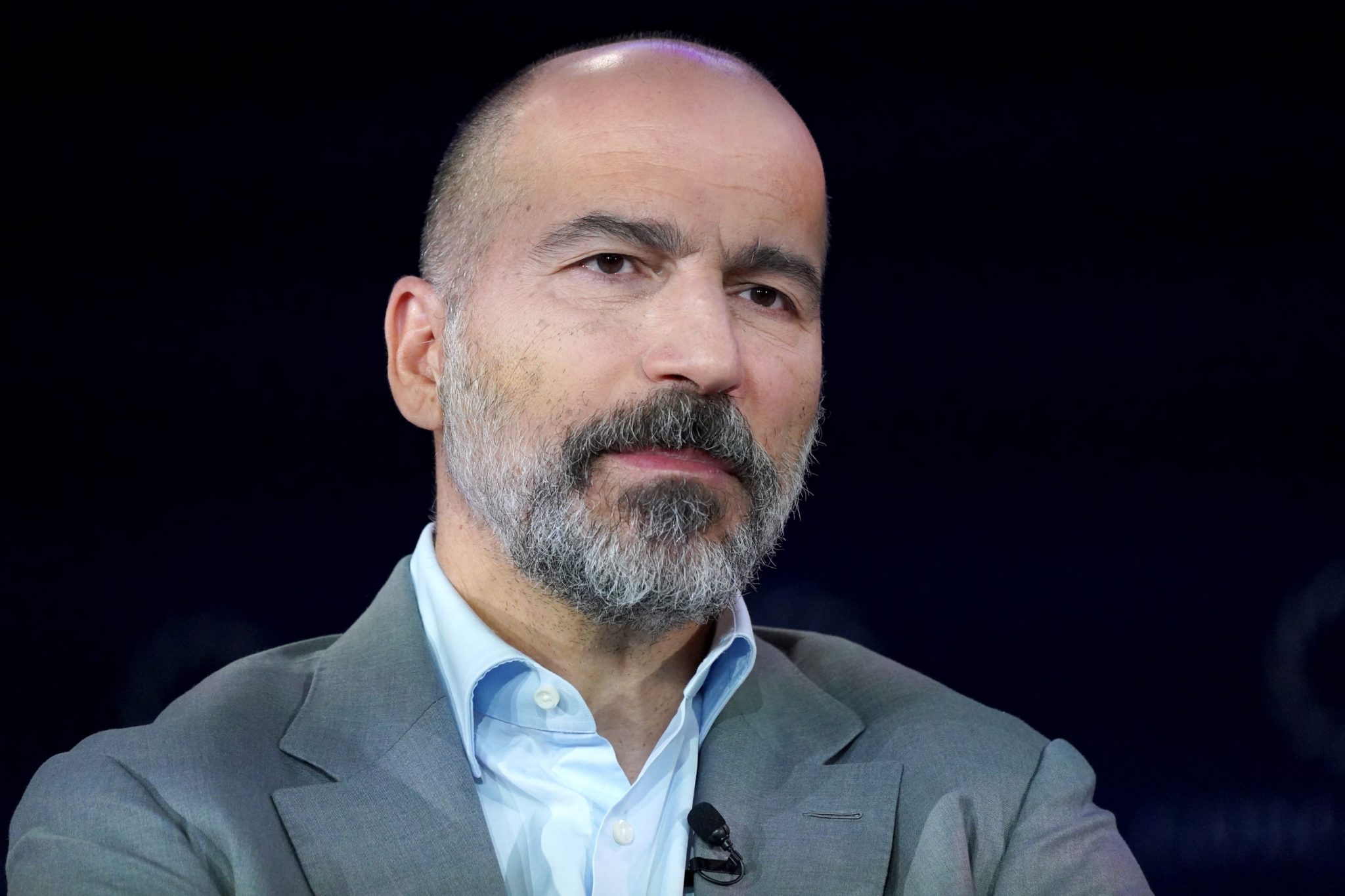

Uber reported operating income of $1.11 billion for the quarter ended September 30, well below analysts’ expectations of $1.62 billion. Chief Financial Officer Prashanth Mahendra-Rajah attributed the loss in part to these legal and regulatory issues during the company’s earnings call, although Uber did not provide specific details about which cases or settlements were covered by the charges.

Legal expenses appear in Uber’s financial statements as part of “certain legal, tax and regulatory reserve changes and settlements,” an item the company uses when calculating adjusted EBITDA. According to Uber’s financial reportthese matters involve “certain significant legal proceedings or government investigations” that have “limited precedent, cover an extended historical period, and are difficult to predict in size and timing.”

Uber did not immediately respond wealthRequest for comment.

Full throttle, no brakes

Although profits fell short of target, Uber reported quarterly revenue of $13.47 billion, a 20% increase from the previous year and exceeding Wall Street expectations of $13.28 billion. Gross bookings – the total value of rides, deliveries and other services on its platform – rose 21% to $49.74 billion, beating analysts’ expectations of $48.73 billion.

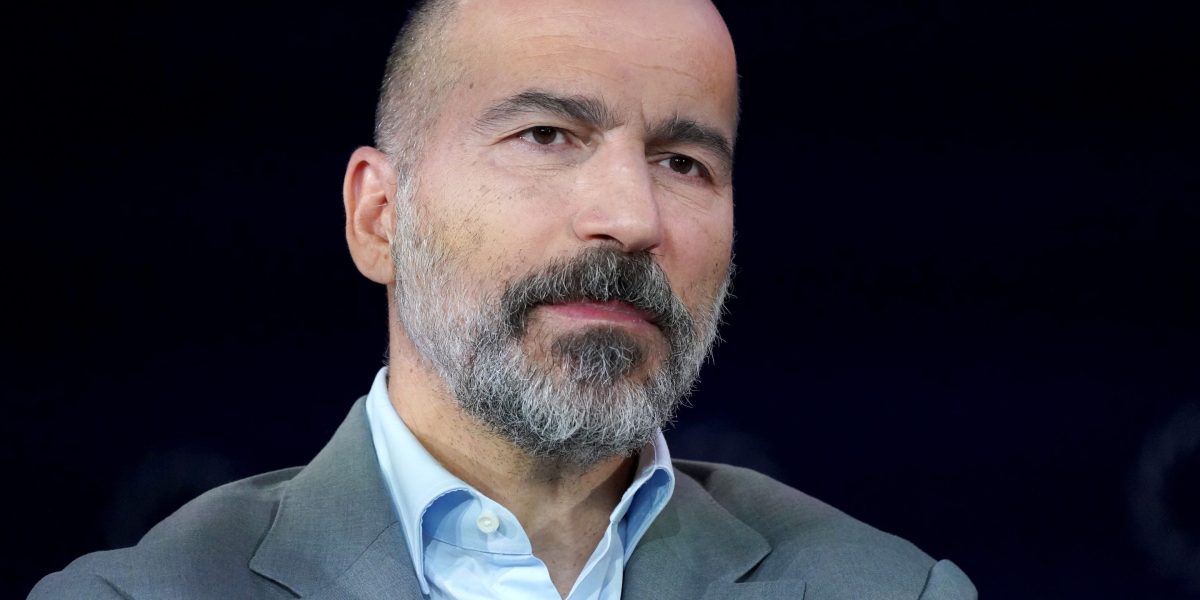

“Uber’s growth kicked into high gear in the third quarter, marking one of the largest ride volume gains in the company’s history,” CEO Dara Khosrowshahi said in a statement. The company’s ride volume reached 3.5 billion in the quarter, up 22% from the same period last year.

Net profit for the quarter reached $6.62 billion, or $3.11 per share, compared with $2.61 billion, or $1.20 per share, in the same period last year. However, the net profit figure included a $4.9 billion gain from the tax valuation release, meaning the company’s operating results were far less robust than the headline number suggested.

Uber’s legal battle

The legal charge comes as Uber faces multiple legal battles on different fronts. In September, the U.S. Department of Justice Filed $125 million lawsuit Accused the company of discriminating against passengers with disabilities. Uber also has it File your own RICO lawsuit Targeting personal injury attorneys in several states claiming they conspired with medical providers to inflate minor accident claims.

As of Tuesday morning, Uber’s shares were down about 7% following the earnings release, despite having gained about 46% so far this year. The decline reflected investor disappointment over third-quarter profit misses and the company’s fourth-quarter guidance, which called for adjusted EBITDA of between $2.41 billion and $2.51 billion, slightly below analysts’ expectations of $2.48 billion.

Uber expects fourth-quarter gross bookings to be between $52.25 billion and $53.75 billion, an increase of 17% to 21% on a constant currency basis. The company also announced that it will report adjusted profit forecasts instead of adjusted EBITDA starting with first-quarter 2026 guidance, in line with what is typical for more mature companies.

Mahendra-Raja stressed that despite the legal blow, the company’s overall financial position remains good. “We delivered another impressive quarter in terms of revenue and profits, with growth accelerating and profitability at an all-time high,” he said in prepared remarks. “This consistent execution positions us well to invest in many accretive growth opportunities ahead while maintaining our commitment to returning capital to shareholders.”

For this story, wealth Use generative artificial intelligence to help complete your first draft. Editors verified information for accuracy before publication.